Rhodium Demand Background

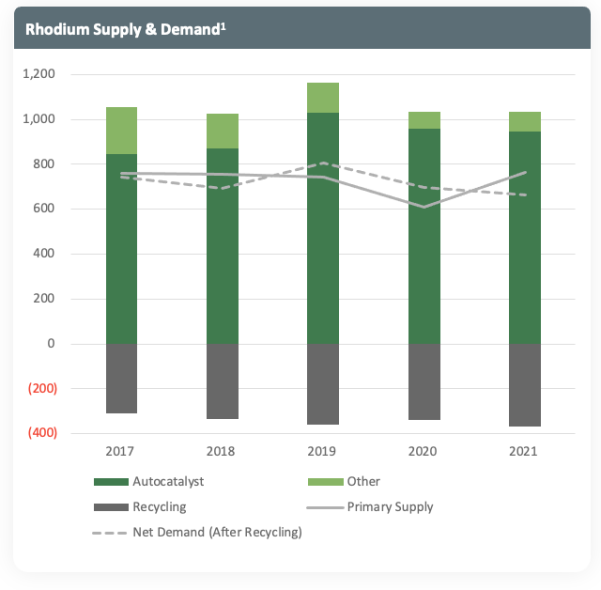

Rhodium demand is usually relatively price inelastic, partly due to its history of extreme price movements combined with the lack of economic or technically viable substitution alternatives. Demand is dominated by the autocatalyst sector where rhodium is required for nitrous oxide (NOx) emissions after-treatment. While many automakers have aimed to reduce their rhodium consumption over recent years there has been a minimal impact on total demand as all gasoline after-treatment systems use small amounts of rhodium. This is particularly relevant to rhodium demand as most counties have tightened emissions regulation, resulting in reduced NOx limits. This has increased global rhodium loadings by over 40% since 2016. Rhodium loadings increased in Europe and North American due to enforcement of Euro 6d legislations and phasing in of Tier 3 US Federal regulations. Most automakers have focused on meeting these stricter emissions limits versus thrifting. Remaining rhodium demand is mainly from the chemical and glass sectors.

Rhodium Supply/Demand Summary

- Essential in treating NOx emissions from gasoline engines3

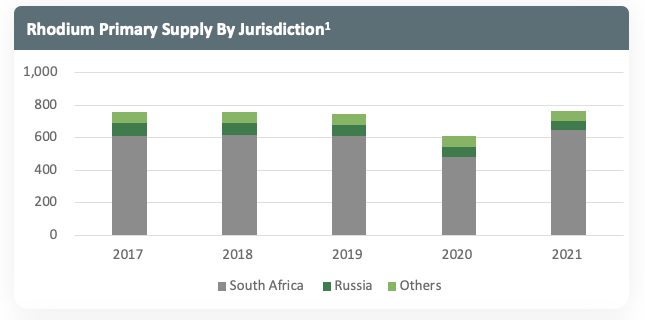

- 91% of supply from high-risk jurisdictions, Russia and South Africa3, supply diversification required

- Recycling capacity constrained3, primary supply forecast to decline from 2021 to 20322 with biggest declines in South Africa, near and medium-term Russian supply uncertainties2,3

- Stricter global ICE vehicle emission standards have resulted in increased demand3

- Limited opportunities to reduce rhodium in industrial use, expect in glass sector3

1Johnson Matthey PGM Market Reports May 2020 and 2022; 2SFA (Oxford); 3Johnson Matthey PGM Market Report May 2022