Work Streams Advancing Upside Potential on Multiple Fronts

VANCOUVER, March 24, 2025 – Bravo Mining Corp. (TSX.V: BRVO, OTCQX: BRVMF), (“Bravo” or the “Company”) is pleased to announce its strategic priorities for its 100% owned Luanga project including work to advance its palladium + platinum + rhodium + gold + nickel deposit (“Luanga deposit” or “Luanga PGM+Au+Ni deposit”) as well as its copper-gold +/- nickel exploration targets, all located in the Carajás Mineral Province, Pará State, Brazil.

“With a strong balance sheet, a recently updated mineral resource with more tonnes at higher grade, and a granted preliminary licence, Bravo is well placed to benefit from renewed interest in PGMs. We have initiated a focused 2025 program that we are advancing on multiple fronts - building on our IOCG and magmatic Ni-Cu exploration successes while continuing to advance the potential of the Luanga PGM-Au-Ni deposit through a metallurgical optimization program,” said Luis Azevedo, Chairman and CEO. “We are just in the early stages of understanding Luanga’s broader mineral potential beyond our PGM+Au+Ni deposit, yet we have already made multiple discoveries of a variety of styles of copper, nickel, PGM and gold mineralization across our holdings. As we refine our modelling and interpretation of our numerous exploration targets and drill test them, we see potential for the discovery of new magmatic and IOCG-style deposits typical of the Carajás, one of the most well-endowed mineral belts in the world.”

Highlights Include:

- Drill testing of HeliTEM targets in 2024 returned encouraging results for several different styles of mineralization, outside of the known Luanga PGM+Au+Ni deposit, including:

- High Cu, low Ni (negligible PGM+Au) mineralization at T1 and T2

- Low Cu, high Ni + PGM + Au at T3

- High Cu, High Au (IOCG) mineralization at T5

- Moderate Cu + moderate Ni (negligible PGM+Au) mineralization at T6 and T16

These results indicate potential not just for IOCG mineralization as drilled at T5, but several other styles of mineralization where significant Cu is present, in contrast to the 8.1km of strike at the Luanga deposit, which contains negligible Cu. These targets warrant immediate follow-up work in 2025.

- The 2025 budgeted work program for the Luanga Project will be focused on two principal streams:

- Exploration: Focused on (a) the recently discovered potential for Iron Oxide Copper Gold (“IOCG”) mineralization, and (b) the continuation of magmatic Ni/Cu exploration.

- Metallurgy: Luanga PGM+Au+Ni Deposit - Additional metallurgical testing focused on optimizing recoveries and concentrate grades of concentrates for all styles of mineralization, providing potential for increased payabilities.

- IOCG Exploration will soon commence with four planned drill holes at T5, followed by:

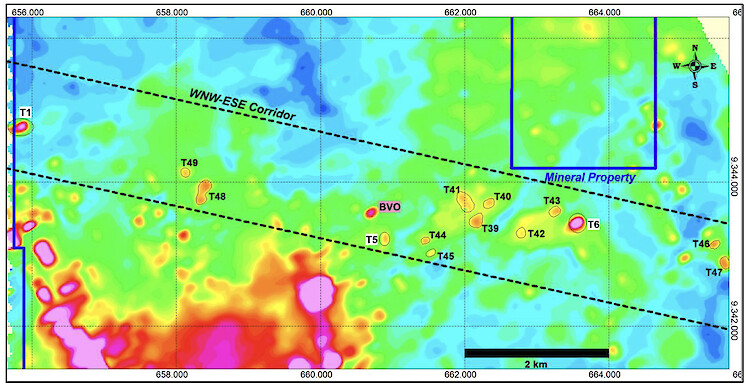

- Testing of newly selected HeliTEM targets located in the same structural corridor that hosts the T5 IOCG mineralization, including the recently selected T39 to T49 targets (Figure 1).

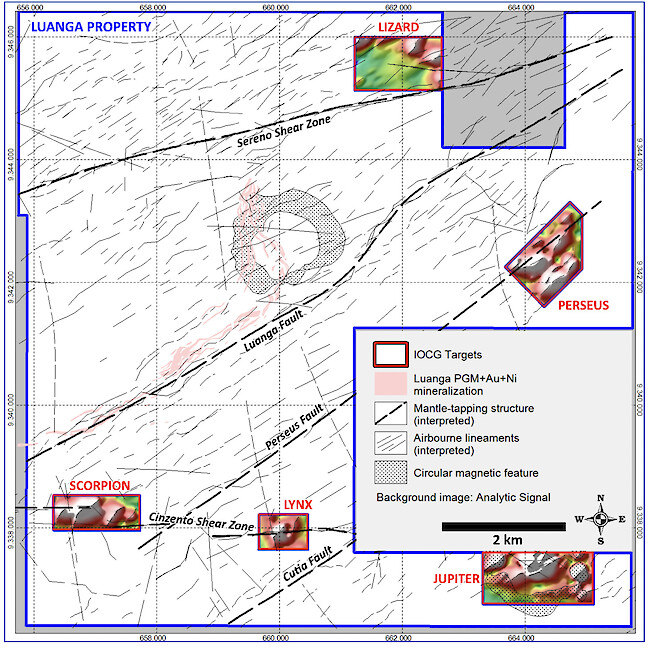

- Advancement of five Cu-Au targets (Figure 2) with potential for large-scale, IOCG-style, disseminated sulphide mineralization (Lizard, Scorpion, Jupiter, Lynx and Perseus exploration targets).

- Phase 1 scout drilling, totalling 7,000 metres, with potential for additional drilling, based on the results received.

- The approved work program will be carried on throughout 2025.

- Strong cash position – US$ 26.1 million as of September 30, 2024 (last reported financial statements).

2025 Work Program

The 2025 exploration program is divided into two areas of focus:

- Exploration focused on (a) the recently demonstrated potential for IOCG-style mineralization and (b) the continuation of magmatic Ni/Cu exploration, based on exploration targets generated from the previously completed helicopter electromagnetic (“EM”) survey (“HeliTEM’’) as well as those selected based on regional structures, aeromagnetic anomalies and Cu-in-soil anomalies.

- Continued work on the advanced stage Luanga PGM+Au+Ni deposit, with focus on further metallurgical test work, continuing optimization and variability studies.

1. Exploration for IOCG and magmatic Ni/Cu sulphide mineralization over the entire Luanga property

A. Continue with exploration (geological mapping, geochemistry, geophysics and auger drilling) over newly selected HeliTEM targets located in the same structural corridor that hosts the high-grade T5 IOCG mineralization. This includes the recently selected T39 to T49 exploration targets (Figure 1). Subsequent drill testing of prioritized exploration targets will be success-driven, with 7,000 metres of scout diamond drilling in the 2025 work program.

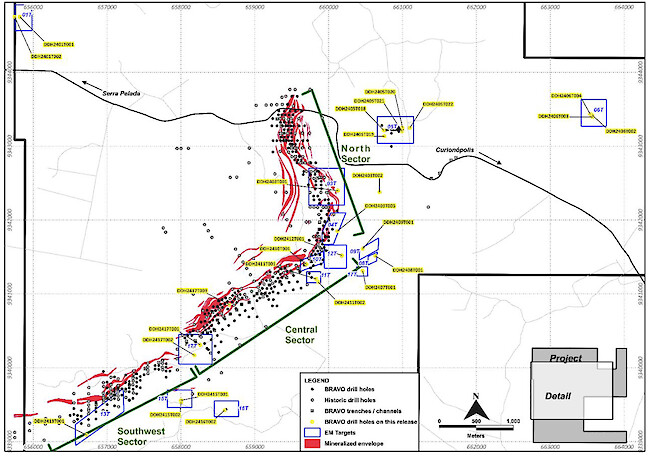

Figure 1: Location of HeliTEM target selected: T1, T5, T6, T39, T40, T41, T42, T43, T45, T46, T47, T48 and T49.

- Exploration over five Cu-Au targets (Figure 2) selected for their potential to host large-scale, IOCG-style disseminated sulphide mineralization. These targets were chosen based on key indicators, including proximity to significant mantle-tapping structures known to host other IOCG deposits in the region, airborne magnetic high signatures that could relate to IOCG alteration, and Cu-in-soil anomalies. These targets are ranked by priority from 1 to 5 respectively, Lizard (#1) proximal to the Sereno shear zone, Scorpion, Jupiter, Lynx on the Cinzento shear zone, and Perseus (#5).

Figure 2: Location of Lizard, Scorpion, Jupiter, Lynx and Perseus.

B. Advance exploration on HeliTEM targets that returned encouraging drill results in 2024, including the T1, T3, T5, T6 and T16 exploration targets. The Company has now received all outstanding results, including re-analysis and additional element analysis, from 2024 scout drilling at HeliTEM targets on the Luanga property.

- T1 Target

Two drill holes were drilled in 2024 at the T1 EM target (Figure 1 and 6), totalling 305 metres. Both holes intercepted narrow semi-massive sulphide intervals containing high Cu, low Ni (with negligible PGM+Au) mineralization, with biotite-amphibole-carbonate hydrothermal alteration plus quartz veining. This style of mineralization stands in stark contrast to the 8.1km of strike at the Luanga deposit, which has negligible Cu present. The best intercept returned 1.7m @ 1.91% Cu, 0.13% Ni (DDH2401T002), demonstrating potential for other types of massive and semi-massive sulphides in the area. The local country rock is a tonalitic intrusion, and the geological/mineralogical system appears to be similar to the T5 Cu-Au exploration target and therefore warrants additional work to vector in on the source of Cu. Follow up work is planned in Q2/2025.

- T3 Target

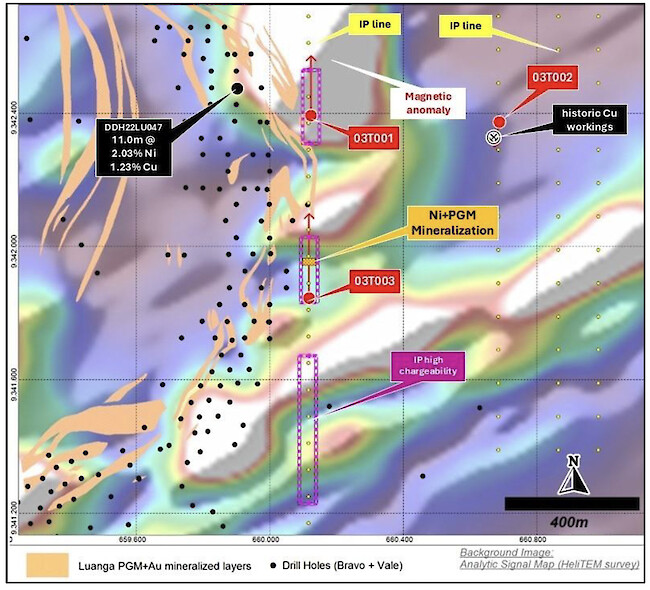

A total of three drill holes (DDH2403T001, DDH2403T002 & DDH2403T003) were drilled at the T3 Target (Figure 3 and 6), totalling 1,001 metres, all three of which intercepted mineralization. Results to date again demonstrate the presence of high Cu (unlike the Luanga deposit) and, in this case, associated with Ni and PGM mineralization. The T3 exploration target is only partially tested and warrants additional work to evaluate the potential for larger scale, potentially higher grade mineralization similar to that intercepted in DDH23LU047 (11m @ 4.24 g/t 3PGM+Au, 2.04% Ni + 1.23% Cu, see news release dated October 17, 2022).

- Drill hole DDH2403T001 tested the strong magnetic anomaly located close to the Ni/Cu/PGM massive sulphide zone intercepted in hole DDH23LU047. The best intercept in DDH2403T001 was 1.0m @ 0.52% Ni.

- Drill hole DDH2403T002 was drilled to test the down dip extension of a Cu occurrence previously worked by artisanal miners (“garimpeiros”). The hole intercepted 1.00m @ 0.90% Cu, confirming the presence of Cu mineralization in the area.

- Drill hole DDH2403T003 was drilled on the same section of DDH2403T001 to test an IP chargeability anomaly. The hole intercepted 35.5m @ 0.92g/t PGM+Au, 0.39% Ni, 0.09% Cu associated with a sulphide-bearing orthopyroxenite sequence. Follow up work is planned in Q2/2025.

The search for more mineralization similar to that intercepted in hole DDH23LU047 continues in and around the T3 area.

Figure 3: T3 Target.

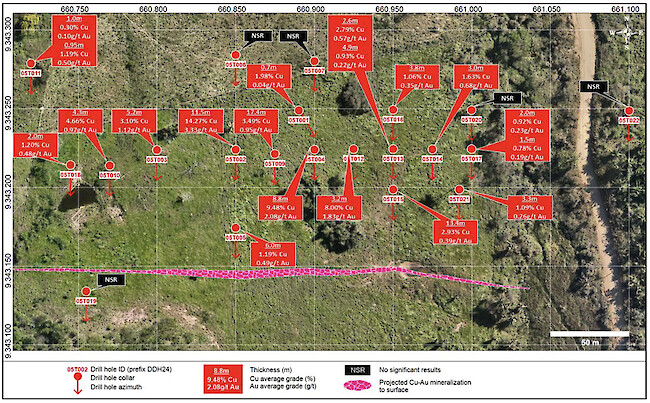

- T5 Target

Since the start of drilling at the T5 exploration target (Figure 1 and 6), 22 drill holes have been completed totalling 4,922 metres of diamond drilling. These holes have defined a zone of high-grade, IOCG-style mineralization, including intercepts of 11.5m @ 14.3% Cu, 3.3g/t Au and 8.8m @ 9.5% Cu, 2.1g/t Au (see press release dated May 28, 2024 and June 10, 2024). Recently, assay results have been received for the last five holes completed on the margins of the T5 mineralized system (Figure 4 and Table of Recent Intercepts below).

Follow-up drilling (four diamond holes) at T5 is planned to commence in Q2/2025 to test for possible down plunge extensions to mineralization, possible feeder zones and a potential larger source for the massive sulphides intercepted to date.

Figure 4: T5 Target.

- T6 Target

As previously reported (see news release dated May 28, 2024), the mineralization apparently responsible for the T6 conductor (Figure 1 and 6) consists of 6m of massive/semi-massive/breccia sulphides, predominantly pyrrhotite, with the best intercept comprising 3.8m @ 0.48% Cu, 0.11% Ni in hole DDH2416T002.

Results show moderate Cu + moderate Ni in magmatic sulphides, and unlike the Luanga deposit, there is negligible PGM+Au mineralization present.

Given the significant intercept of magmatic sulphides, further work is warranted, starting with a comprehensive review of the HeliTEM and borehole electromagnetic (“BHEM”) survey data collected to date to evaluate potential for extensions or feeder zones to the mineralization identified to date.

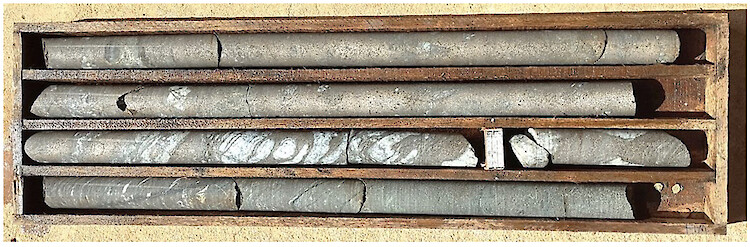

Figure 5: DDH2406T002 Massive/semi-massive/ breccia sulphide mineralization at T6 target (57.0 – 60.7m shown).

- T16 Target

A follow-up diamond hole (DDH2416T002) was drilled in 2024 at the T16 (Figure 6) target, for 150 metres. The drill hole intercepted two narrow semi-massive sulphide intervals hosted in mafic volcanic rocks overprinted by a biotite-amphibole-carbonate hydrothermal alteration, with the best intercept returning 3.0m @ 0.87% Cu, 0.48% Ni in DDH2416T002. The hydrothermal alteration system is similar to that associated with the high-grade T5 IOCG Cu-Au mineralization, while the mineralization is distinctly different. Follow-up work is planned, commencing with a review of HeliTEM and BHEM results to evaluate potential for extensions or feeder zones to the mineralization identified to date.

Figure 6: Location of Bravo Drilling reported in this News Release.

2. Luanga PGM+Au+Ni Deposit Work Plans

- Initial focus on finalizing the remaining 2024 metallurgical test work programs, followed by a program focused on optimizing recoveries and concentrate grades with a view to enhanced payabilities from third-party downstream processing facilities. This test work is already underway at third-party metallurgical facilities in Canada.

- Complete a carbon capture study on future tailings and/or waste rocks from the Luanga deposit with a view to evaluating the opportunity to take advantage of the natural potential of the host rocks at Luanga to absorb and permanently fix carbon dioxide from the atmosphere.

- Evaluate other PGM opportunities: Re-evaluate historic data from the Luanga South and Luanga North layered mafic-ultramafic intrusions (where they are located inside the Luanga property), assessing exploration potential in light of knowledge gained in and around the Luanga deposit, and conducting drill testing of priority targets, if warranted.

The approved budget for 2025 allows the company to implement these programs simultaneously, at a steady pace throughout 2025.

Note: Exploration targets and/or exploration zones and/or exploration areas are speculative and there is no certainty that any future work or evaluation will lead to the definition of a mineral resource.

Complete Table of Recent Intercepts.

|

HOLE-ID |

From |

To |

Thickness |

Cu* (%) |

Ni* (%) |

Au |

Pd |

Pt |

Rh |

PGM + Au |

TYPE |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

DDH2401T001 |

69.3 |

71.4 |

2.1 |

0.13 |

0.05 |

0.02 |

-- |

-- |

-- |

-- |

FR |

|

DDH2401T002 |

94.0 |

95.7 |

1.7 |

1.91 |

0.13 |

0.04 |

-- |

-- |

-- |

-- |

FR |

|

DDH2403T001 |

0.0 |

10.3 |

10.3 |

NA |

NA |

0.08 |

0.36 |

0.15 |

|

0.59 |

Ox |

|

DDH2403T002 |

50.30 |

51.30 |

1.0 |

0.90 |

0.01 |

0.02 |

<0.01 |

<0.01 |

-- |

|

|

|

|

No Significant Result |

||||||||||

|

DDH2403T003 |

191.6 |

227.1 |

35.5 |

0.09 |

0.39 |

0.08 |

0.58 |

0.15 |

0.11 |

0.92 |

FR |

|

DDH2405T018 |

54.4 |

56.4 |

2.0 |

1.20 |

0.01 |

0.48 |

-- |

-- |

-- |

-- |

FR |

|

DDH2405T019 |

No Significant Result |

||||||||||

|

DDH2405T020 |

No Significant Result |

||||||||||

|

DDH2405T021 |

139.3 |

142.6 |

3.3 |

1.09 |

0.01 |

0.26 |

-- |

-- |

-- |

-- |

FR |

|

DDH2405T022 |

No Significant Result |

||||||||||

|

DDH2406T002 |

54.8 |

58.6 |

3.8 |

0.48 |

0.11 |

0.01 |

<0.01 |

<0.01 |

<0.01 |

<0.01 |

FR |

|

DDH2406T003 |

75.3 |

77.0 |

1.7 |

0.16 |

0.04 |

0.02 |

-- |

-- |

-- |

-- |

FR |

|

DDH2406T004 |

34.9 |

37.2 |

2.3 |

0.37 |

0.03 |

0.03 |

-- |

-- |

-- |

-- |

FR |

|

DDH2407T001 |

No Significant Result |

||||||||||

|

DDH2408T001 |

No Significant Result |

||||||||||

|

DDH2409T001 |

No Significant Result |

||||||||||

|

DDH2410T001 |

77.6 |

81.2 |

3.6 |

0.28 |

0.56 |

0.06 |

0.91 |

0.30 |

0.01 |

1.28 |

FR |

|

And |

83.8 |

84.7 |

0.9 |

0.12 |

0.51 |

0.06 |

0.85 |

0.27 |

<0.01 |

1.18 |

FR |

|

And |

129.3 |

132.3 |

3.0 |

0.06 |

0.26 |

0.01 |

0.60 |

0.27 |

0.09 |

0.97 |

FR |

|

And |

138.3 |

146.3 |

8.0 |

0.03 |

0.26 |

0.01 |

0.56 |

0.26 |

0.10 |

0.93 |

FR |

|

And |

149.3 |

157.3 |

8.0 |

0.03 |

0.17 |

0.04 |

0.91 |

0.43 |

0.09 |

1.47 |

FR |

|

DDH2411T001 |

No Significant Result |

||||||||||

|

DDH2412T001 |

No Significant Result |

||||||||||

|

DDH2413T001 |

121.0 |

122.1 |

1.1 |

-- |

0.53 |

0.01 |

0.01 |

<0.01 |

<0.01 |

<0.01 |

FR |

|

DDH2415T001 |

101.5 |

103.5 |

2.0 |

0.03 |

0.15 |

0.02 |

0.07 |

0.02 |

0.03 |

0.15 |

FR |

|

DDH2415T002 |

83.7 |

84.7 |

1.0 |

0.51 |

0.19 |

0.02 |

0.02 |

0.01 |

<0.01 |

0.05 |

FR |

|

And |

146.6 |

147.6 |

1.0 |

<0.01 |

0.62 |

0.01 |

0.29 |

0.01 |

<0.01 |

0.31 |

FR |

|

DDH2416T002 |

99.3 |

102.3 |

3.0 |

0.87 |

0.48 |

0.04 |

0.04 |

0.01 |

<0.01 |

0.08 |

FR |

|

And |

109.3 |

112.3 |

3.0 |

0.32 |

0.21 |

0.03 |

0.05 |

0.01 |

<0.01 |

0.09 |

FR |

|

DDH2417T001 |

107.2 |

108.2 |

1.0 |

0.26 |

0.35 |

0.01 |

0.07 |

0.14 |

<0.01 |

0.22 |

FR |

|

DDH2417T002 |

168.8 |

169.8 |

1.0 |

0.11 |

0.91 |

0.02 |

0.01 |

<0.01 |

<0.01 |

0.03 |

FR |

|

DDH2417T003 |

No Significant Result |

||||||||||

Notes:

All ‘From’, ‘To’ depths, and ‘Thicknesses’ are downhole. ‘NA’ Not applicable for Oxide material. ‘--’ Not Assayed.

At T5 thicknesses are estimated at 140% of true thickness. For all other targets the true thickness of mineralization is currently unknown.

Type: Ox = Oxide. FR = Fresh Recovery methods and results will differ based on the type of mineralization.

* Bravo’s nickel grades are sulphide nickel, and do not include non-recoverable silicate nickel.

About Bravo Mining Corp.

Bravo is a Canadian and Brazil-based mineral exploration and development company focused on advancing its PGM+Au+Ni Luanga Project, as well as our Cu-Au +/- Ni exploration opportunities in the world-class Carajás Mineral Province, Para State, Brazil.

Bravo is one of the most experienced explorers in Carajás. The team, comprising of local and international geologists, has a proven track record of PGM, nickel, and copper discoveries in the region. They have successfully taken a past IOCG greenfield project from discovery to development and production in the Carajás.

The Luanga Project is situated on mature freehold farming land and benefits from being located close to operating mines and a mining-experienced workforce, with excellent access and proximity to existing infrastructure, including road, rail, ports, and hydroelectric grid power. Bravo’s current Environmental, Social and Governance activities includes planting more than 35,000 high-value trees in and around the project area, while hiring and contracting locally.

In 2025, the Luanga Project was granted a preliminary licence (see news release dated March 3, 2025) for the development of the project. Combined with the recently updated Mineral Resource Estimate which increased both tonnes and grade (see news release dated February 18, 2025), this places Luanga at the forefront of potential future PGM+Au+Ni projects globally, while benefitting from extensive infrastructure, an experienced work force, shallow depths amenable to potential open pit extraction, and in a geopolitically favourable location close to end-user markets.

Technical Disclosure

Technical information in this news release has been reviewed and approved by Simon Mottram, F.AusIMM (Fellow Australia Institute of Mining and Metallurgy), President of Bravo Mining Corp. who serves as the Company’s “qualified person” as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr. Mottram has verified the technical data and opinions contained in this news release.

For further information about Bravo, please visit www.bravomining.com or contact:

Luis Azevedo, Chairman and CEO or

Alex Penha, EVP Corporate Development

T: +1-416-509-0583

info@bravomining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as “advance”, “upside”, “potential”, “multiple”, “update”, “more”, “priority”, “significant”, “encourage”, “best”, “extension”, “large”, “substantial”, “enhance”, “opportunity”, “successful”, “high”, “optimize”, underscore”, “well-placed”, “renewed interest”, variants of these words and other similar words, phrases, or statements that certain events or conditions “may” or “will” occur. This news release contains forward-looking information pertaining to the Company’s planned 2025 exploration programs and the results thereof; the potential for new and/or different styles of mineralization, such as IOCG style, the presence of which is publicly well documented in the Carajás mineral province; whether or not the mineralization interested at T5 is in fact IOCG-style, some variant of such or another style of mineralization; whether the other EM, soil, or magnetic anomalies are related to mineralization; whether further exploration of the T39 to T49, Luanga North and Luanga South, Lizard, Scorpion, Jupiter, Lynx, or Perseus exploration targets will result in the discovery of additional mineralization of potential economic interest; the potential for extensions, higher grade and/or thicker zones of mineralization, feeder zones and sources of massive sulphides; whether or not metallurgical test programs will improve recoveries, concentrate grades and/or payabilities; and the Company’s plans in respect thereof. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, unexpected results from exploration programs, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage; and other risks and uncertainties involved in the mineral exploration and development industry. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including, but not limited to, the assumption that exploration activities will lead to positive results; ; that activities will not be adversely disrupted or impeded by regulatory, political, community, economic, environmental and/or healthy and safety risks; that the Luanga Project will not be materially affected by potential supply chain disruptions; and general business and economic conditions will not change in a materially adverse manner. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

Schedule 1: Drill Hole Collar Details

|

HOLE-ID |

Company |

East |

North |

RL |

Datum |

Depth |

Azimuth |

Dip |

Sector |

|---|---|---|---|---|---|---|---|---|---|

|

DDH2401T001 |

Bravo |

655820.07 |

9344749.88 |

180.000 |

SIRGAS2000_UTM_22S |

177.75 |

330.00 |

-60.00 |

T1 Target |

|

DDH2401T002 |

Bravo |

655748.69 |

9344751.85 |

181.531 |

SIRGAS2000_UTM_22S |

127.60 |

270.00 |

-60.00 |

T1 Target |

|

DDH2403T001 |

Bravo |

660122.97 |

9342398.16 |

278.820 |

SIRGAS2000_UTM_22S |

350.35 |

360.00 |

-50.00 |

T3 Target |

|

DDH2403T002 |

Bravo |

660687.98 |

9342377.94 |

201.830 |

SIRGAS2000_UTM_22S |

160.55 |

190.00 |

-60.00 |

T3 Target |

|

DDH2403T003 |

Bravo |

660117.96 |

9341849.99 |

250.970 |

SIRGAS2000_UTM_22S |

490.40 |

360.00 |

-60.00 |

T3 Target |

|

DDH2405T018 |

Bravo |

660745.01 |

9343214.87 |

196.900 |

SIRGAS2000_UTM_22S |

200.35 |

180.00 |

-60.00 |

T5 Target |

|

DDH2405T019 |

Bravo |

660754.99 |

9343134.79 |

206.120 |

SIRGAS2000_UTM_22S |

200.50 |

180.00 |

-60.00 |

T5 Target |

|

DDH2405T020 |

Bravo |

660999.95 |

9343249.82 |

181.030 |

SIRGAS2000_UTM_22S |

220.80 |

180.00 |

-60.00 |

T5 Target |

|

DDH2405T021 |

Bravo |

660992.03 |

9343199.36 |

183.360 |

SIRGAS2000_UTM_22S |

180.90 |

180.00 |

-60.00 |

T5 Target |

|

DDH2405T022 |

Bravo |

661099.99 |

9343249.39 |

184.760 |

SIRGAS2000_UTM_22S |

250.65 |

180.00 |

-50.00 |

T5 Target |

|

DDH2406T002 |

Bravo |

663569.79 |

9343420.43 |

200.550 |

SIRGAS2000_UTM_22S |

90.75 |

0.00 |

-60.00 |

T6 Target |

|

DDH2406T003 |

Bravo |

663570.00 |

9343395.73 |

199.680 |

SIRGAS2000_UTM_22S |

101.05 |

0.00 |

-60.00 |

T6 Target |

|

DDH2406T004 |

Bravo |

663540.04 |

9343435.24 |

195.210 |

SIRGAS2000_UTM_22S |

81.05 |

0.00 |

-60.00 |

T6 Target |

|

DDH2407T001 |

Bravo |

660459.77 |

9341310.50 |

185.472 |

SIRGAS2000_UTM_22S |

149.40 |

330.00 |

-60.00 |

T7 Target |

|

DDH2408T001 |

Bravo |

660630.03 |

9341515.02 |

188.074 |

SIRGAS2000_UTM_22S |

150.20 |

330.00 |

-60.00 |

T8 Target |

|

DDH2409T001 |

Bravo |

660460.09 |

9341609.86 |

198.003 |

SIRGAS2000_UTM_22S |

200.50 |

150.00 |

-70.00 |

T9 Target |

|

DDH2410T001 |

Bravo |

659698.88 |

9341401.89 |

203.188 |

SIRGAS2000_UTM_22S |

210.65 |

330.00 |

-60.00 |

T10 Target |

|

DDH2411T001 |

Bravo |

659829.74 |

9341203.24 |

180.447 |

SIRGAS2000_UTM_22S |

233.70 |

330.00 |

-60.00 |

T11 Target |

|

DDH2411T002 |

Bravo |

659859.87 |

9341160.21 |

178.870 |

SIRGAS2000_UTM_22S |

288.90 |

330.00 |

-60.00 |

T11 Target |

|

DDH2412T001 |

Bravo |

660179.24 |

9341520.00 |

203.347 |

SIRGAS2000_UTM_22S |

200.00 |

330.00 |

-60.00 |

T12 Target |

|

DDH2413T001 |

Bravo |

656720.06 |

9339089.84 |

219.461 |

SIRGAS2000_UTM_22S |

170.25 |

330.00 |

-60.00 |

T13 Target |

|

DDH2415T001 |

Bravo |

657999.98 |

9339559.96 |

199.411 |

SIRGAS2000_UTM_22S |

190.30 |

330.00 |

-60.00 |

T15 Target |

|

DDH2415T002 |

Bravo |

658002.16 |

9339536.23 |

195.600 |

SIRGAS2000_UTM_22S |

150.40 |

330.00 |

-60.00 |

T15 Target |

|

DDH2416T002 |

Bravo |

658589.75 |

9339425.36 |

192.110 |

SIRGAS2000_UTM_22S |

150.15 |

330.00 |

-60.00 |

T16 Target |

|

DDH2417T001 |

Bravo |

658259.95 |

9340310.19 |

254.309 |

SIRGAS2000_UTM_22S |

161.80 |

330.00 |

-60.00 |

T17 Target |

|

DDH2417T002 |

Bravo |

658180.16 |

9340169.77 |

246.954 |

SIRGAS2000_UTM_22S |

180.40 |

150.00 |

-60.00 |

T17 Target |

|

DDH2417T003 |

Bravo |

658655.83 |

9340855.02 |

245.410 |

SIRGAS2000_UTM_22S |

200.40 |

150.00 |

-50.00 |

T17 Target |

Schedule 2: Assay Methodologies and QAQC

Samples follow a chain of custody between collection, processing, and delivery to the SGS Geosol laboratory in Parauapebas, state of Pará, Brazil. The drill core is delivered to the core shack at Bravo’s Luanga site facilities and processed by geologists who insert certified reference materials, blanks, and duplicates into the sampling sequence. Drill core is half cut and placed in secured polyurethane bags, then in security-sealed sacks before being delivered directly from the Luanga site facilities to the Parauapebas SGS Geosol laboratory by Bravo staff. Additional information about the methodology can be found on the SGS Geosol website (SGS) in their analytical guides. Information regarding preparation and analysis of historic drill core is also presented in the table below, where the information is known.

Quality Assurance and Quality Control (“QAQC”) is maintained internally at the lab through rigorous use of internal certified reference materials, blanks, and duplicates. An additional QAQC program is administered by Bravo using certified reference materials, duplicate samples and blank samples that are blindly inserted into the sample batch. If a QAQC sample returns an unacceptable value an investigation into the results is triggered and when deemed necessary, the samples that were tested in the batch with the failed QAQC sample are re-tested.

|

Bravo SGS Geosol |

||||

|---|---|---|---|---|

|

Preparation |

Method |

Method |

Method |

Method |

|

For All Elements |

Pt, Pd, Au |

Rh |

Sulphide Ni, Cu |

Trace Elements |

|

PRPCLI (85% at 200#) |

FAI515 |

FAI30V |

AA04B |

ICP40B |