Palladium Demand Background

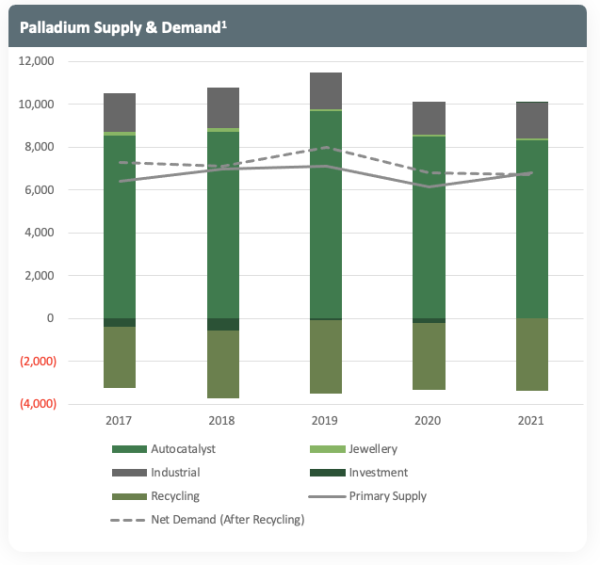

Palladium demand is most exposed to the Internal Combustion Engine (ICE) automotive sector with ~83% of total demand. Stricter global ICE vehicle emission standards have caused an increased demand, particularly in Europe with the implementation of Euro 6d, resulting in increased PGM loadings. The same has occurred in the United States due to US Federal Tier 3 legislation where the average palladium content of an ICE vehicle increased. Palladium demand has been slightly lower in “developed” countries due to increased production of electric vehicles, however this has been more than offset by the demand for ICE vehicles in less “developed” countries where light vehicle production increased by 9% in 2021.

Industrial palladium demand was up ~16% in 2021 and is increasingly dominated by the relatively price insensitive chemical sector, which had additional demand over the last four years.

Investment demand, in the form of palladium ETFs, can be a swing factor in demand for palladium. However, demand has decreased from ~3 million ounces to less than 600,000 ounces from 2015 to the start of 2021. There has been a muted investor response to the two recent threats to Russian supplies in the last 18 months – the temporary closure of two large Nornickel Group’s mines in Russia and the Russian invasion of Ukraine.

Palladium Supply & Demand Summary: Demand driven by automotive industry; 2022 primary supply uncertain due to Russian sanctions

Palladium Supply & Demand Summary:

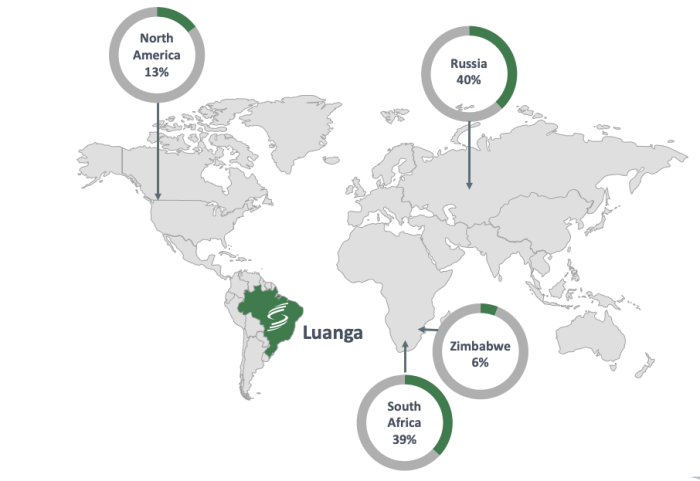

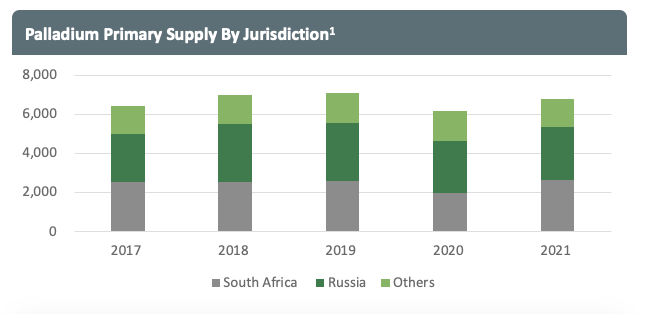

- 79% of supply from high-risk jurisdictions, Russia and South Africa3, supply diversification required

- Recycling capacity constrained3, limited new planned supply from 2021 to 20322, near and medium-term Russuan supply uncertain2, 3

- Stricter global ICE vehicle emission standards have resulted in increased demand3

- Despite increased EV vehicle build out in "developed" countries, rest of the world had increased Pd demand due to 9% increase in light vehicle production3

- Industrial Pd demand increasingly dominated by the relatively price-insensitive chemicals sector3

1Johnson Matthey PGM Market Reports May 2020 and 2022, 2SFA (Oxford), 3Johnson Matthey PGM Market Report May 2022