Platinum Demand Background

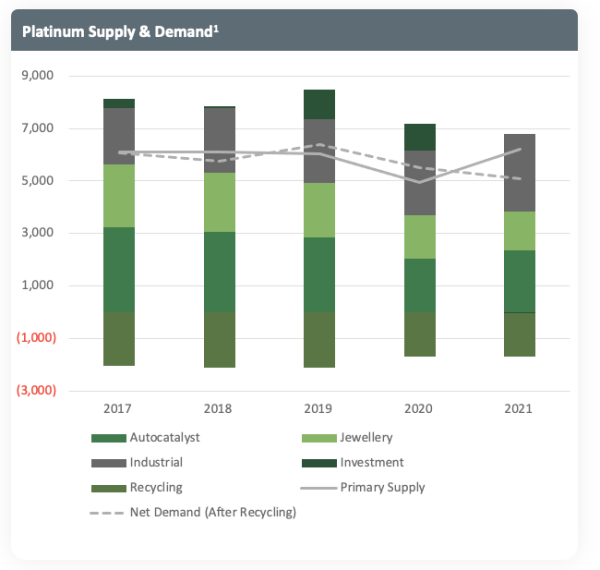

Platinum demand is dominated by the ICE automotive and jewellery sectors at 35% and 22%, respectively. Total demand (excluding investment demand) has declined slightly from 2017, largely due to palladium substitution in the automotive and jewellery sectors. This has been partly offset by increased industrial demand, which set a new record of almost three million ounces in 2021, with the glass industry comprising approximately one-third of the total. Relatively price insensitive chemical demand has also increased. Chinese industrial demand increased approximately four-fold between 2011 to 2021 due to state industrial policy where China has heavily invested in expanding domestic capacity for key industrial products.

Platinum automotive demand rebounded in 2021 from a twenty year low in 2020 with Chinese and North American markets accelerating the use of platinum in gasoline catalysts. Platinum use in “pollution control” includes PGM use in emissions control in non-automotive applications. Stricter emissions regulations across the globe have resulted in catalysts being fitted to all non-road mobile machinery with internal combustion engines. This demand source has begun to increase, particularly ahead of new China IV regulations – scheduled to be enforced from December 2022.

Platinum demand in stationary fuel cells has also increased with installation of power generation large fuel cell systems, particularly in South Korea. This growth is expected to continue as the South Korean Government announced a Hydrogen Portfolio Standard in 2020 for full implementation in 2020. This is aimed at accelerating the hydrogen economy, and while numerous fuel cell technologies will be used platinum-containing technologies are taking a material share of the market.

|

Platinum Industrial Demand (000 oz) |

2020 Actual |

2021 Actual |

2022 Forecast |

|

Chemical |

616 |

638 |

662 |

|

Dental & Biomedical |

233 |

251 |

256 |

|

Electrical & Electronics |

221 |

266 |

289 |

|

Glass |

476 |

913 |

475 |

|

Petroleum |

335 |

236 |

231 |

|

Pollution Control |

176 |

199 |

224 |

|

Other |

417 |

446 |

490 |

|

Total |

2,474 |

2,949 |

2,627 |

Source: Johnson Matthey PGM Market Report May 2022

Like palladium, platinum investment demand can be a swing factor with investment demand adding approximately two million ounces to platinum holdings from 2019 to 2020 due to safe haven demand and supply concerns due to electricity shortages in South Africa. A longer-term value thesis has also driven investor demand based on the premise that near term platinum demand will increase due to expanded use in gasoline autocatalysts and longer-term demand should expand as the hydrogen economy grows in market share.

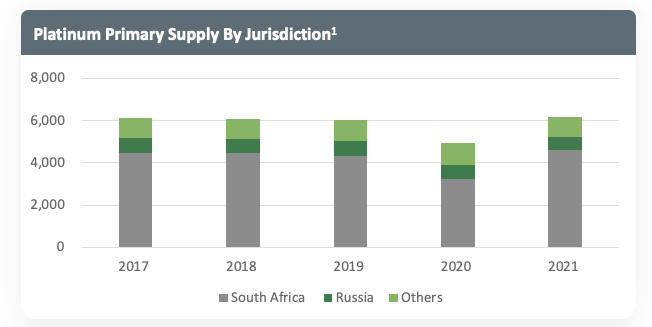

Platinum Supply/Demand Summary

- 85% of supply from high-risk jurisdictions, Russia and South Africa3, supply diversification required

- Recycling capacity constrained3, primary supply forecast to decline from 2021 to 20232, near and medium Russian supply uncertain2, 3

- Stricter global ICE vehicle emission standards have resulted in increased demand3

- Industrial platinum demand set new record of ~3Moz in 2021, dominated by glass industry2

- Future demand driven by hydrogen economy

1Johnson Matthey PGM Market Reports May 2020 and 2022, 2SFA (Oxford), 3Johnson Matthey PGM Market Report May 20223